The Hawksbill Creek Agreement

There is been much said about the formation of Freeport and the Hawksbill Creek Agreement, but today I want to look specifically at the Agreement itself.

This Agreement signed August 5th 1955, was designed to make a “free port” that would encourage foreign investors to come to Grand Bahama Island through a variety of tax exemptions.

It was signed between the Government of The Bahamas and the Grand Bahama Port Authority, which was a private company founded by Virginian financier Wallace Groves.

The Agreement granted the Port, as it is called, the first 50,000 of crown land with exclusive rights to develop.

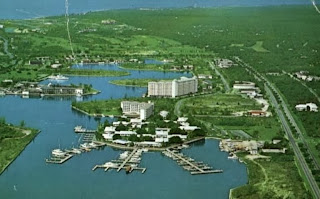

In return, the Port Authority was required to dredge a deepwater harbour, construct an airport, hospitals and schools and provide other services and amenities. Later the Port acquired additional land from the crown and from private sources, giving it a total of 150,000 acres or 233 square miles for development.

Through the years that have been a lot of dispute over how the investors got hold of some of the land, but in the end, right amount of money offered or not, deals were struck and the land was turned over.

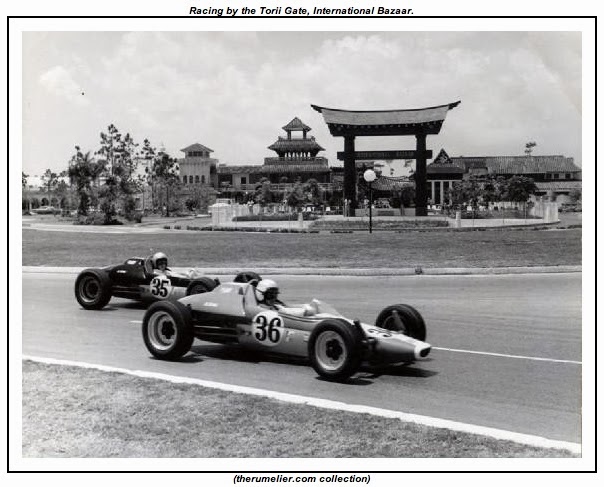

The Government of The Bahamas gave the Port the right to grant business licenses as an incentive and later the Port was given permission to license casinos and to develop tourism within the Freeport area.

The initial agreement, which has been changed throughout the years, was build on residents and licensees in the Port area being free from personal income taxes, corporate profit taxes, capital gains taxes, death taxes or property tax until 1992, then pushed back to 2015 because they felt the time was not right for those taxes.

With 2015 almost here, more discussions will be held with the intentions again to push that date to the end of the Hawksbill Creek Agreement which has a life of 99 years.

The last copy of the Agreement I have attached here for your edification.

Hawksbill Creek Agreement

It is noted that the rest of The Bahamas also has these same freedoms from most of these taxes and if the tax regime in The Bahamas changes, because of the Free Trade Agreement of the Americas, the Hawksbill Creek Agreement would provide a special exemption clause to maintain this tax free status until 2015.

However, what was not foreseen was the Customs Management Taxes that came on board as The Bahamas prepares for VAT to become part of the World Trade Organization, and its affects on the licensees. At present there is a battle afoot led by the Grand Bahama Chamber of Commerce to deal with this matter for the licensees.

Funny enough, according to the write up from The Grand Bahama Port Authority on their page on The Hawksbill Creek Agreement, it says, “The Agreement also provided that residents and licensees also be free from excise taxes, stamp duties and most custom duties until 2054.” This is the basis of the present legal batter being contemplated.

Further, it is noted that companies the have businesses in the Port area are exempt from the Bahamian business licensees fees until August 2054.

Also of notice there is no licensee association and attempts to form one have never really made it through despite the fact that all licensees issued from the Port mentions it.

This Agreement signed August 5th 1955, was designed to make a “free port” that would encourage foreign investors to come to Grand Bahama Island through a variety of tax exemptions.

It was signed between the Government of The Bahamas and the Grand Bahama Port Authority, which was a private company founded by Virginian financier Wallace Groves.

The Agreement granted the Port, as it is called, the first 50,000 of crown land with exclusive rights to develop.

In return, the Port Authority was required to dredge a deepwater harbour, construct an airport, hospitals and schools and provide other services and amenities. Later the Port acquired additional land from the crown and from private sources, giving it a total of 150,000 acres or 233 square miles for development.

Through the years that have been a lot of dispute over how the investors got hold of some of the land, but in the end, right amount of money offered or not, deals were struck and the land was turned over.

The Government of The Bahamas gave the Port the right to grant business licenses as an incentive and later the Port was given permission to license casinos and to develop tourism within the Freeport area.

The initial agreement, which has been changed throughout the years, was build on residents and licensees in the Port area being free from personal income taxes, corporate profit taxes, capital gains taxes, death taxes or property tax until 1992, then pushed back to 2015 because they felt the time was not right for those taxes.

With 2015 almost here, more discussions will be held with the intentions again to push that date to the end of the Hawksbill Creek Agreement which has a life of 99 years.

The last copy of the Agreement I have attached here for your edification.

Hawksbill Creek Agreement

It is noted that the rest of The Bahamas also has these same freedoms from most of these taxes and if the tax regime in The Bahamas changes, because of the Free Trade Agreement of the Americas, the Hawksbill Creek Agreement would provide a special exemption clause to maintain this tax free status until 2015.

However, what was not foreseen was the Customs Management Taxes that came on board as The Bahamas prepares for VAT to become part of the World Trade Organization, and its affects on the licensees. At present there is a battle afoot led by the Grand Bahama Chamber of Commerce to deal with this matter for the licensees.

Funny enough, according to the write up from The Grand Bahama Port Authority on their page on The Hawksbill Creek Agreement, it says, “The Agreement also provided that residents and licensees also be free from excise taxes, stamp duties and most custom duties until 2054.” This is the basis of the present legal batter being contemplated.

Further, it is noted that companies the have businesses in the Port area are exempt from the Bahamian business licensees fees until August 2054.

Also of notice there is no licensee association and attempts to form one have never really made it through despite the fact that all licensees issued from the Port mentions it.

Comments

Post a Comment