The Ease of Doing Business

Last week's post on starting a business in 10 days brought a lot of discussion and I particularly loved what Erik Russell had to say about starting a business:

"Too many people want to start a business in 10 days but have no plan for 10 years. It's like people who spend so much time and money on their wedding without thinking about their marriage. Yes, there are steps you have to go through because that's what responsible entrepreneurs do. Just because you have an idea doesn't mean that you have a viable business. If you are 'open today and closed tomorrow' then you probably shouldn't be in business.

And those that think that a GBPA business license has no value (or is equal to a gov't license), don't know what they are talking about!

There are lots of business opportunities in Freeport, just not enough people that are effective business owners with sufficient capital to start and sustain a business during the startup period (typically 2-3 years). That's not unique to Freeport; that's the way it is in a lot of places."

* Takes place simultaneously with another procedure.

"Too many people want to start a business in 10 days but have no plan for 10 years. It's like people who spend so much time and money on their wedding without thinking about their marriage. Yes, there are steps you have to go through because that's what responsible entrepreneurs do. Just because you have an idea doesn't mean that you have a viable business. If you are 'open today and closed tomorrow' then you probably shouldn't be in business.

And those that think that a GBPA business license has no value (or is equal to a gov't license), don't know what they are talking about!

There are lots of business opportunities in Freeport, just not enough people that are effective business owners with sufficient capital to start and sustain a business during the startup period (typically 2-3 years). That's not unique to Freeport; that's the way it is in a lot of places."

And so I researched The Ease Of Doing Business in The Bahamas and Doing Business In Freeport... all part of how we can bring Grand Bahama back.

According to the World Bank on The Bahamas, we dropped from ranking 74 in the world last year (189 countries) when it comes to the ease of doing business to 84 this year.

To be able to start a business dropped from 78 to 83 and I discovered that the one thing we were better at was in collecting taxes.

Hmmm....

| No. | Procedure | Time to Complete | Associated Costs |

|---|---|---|---|

| 1 | Search for a Company name and reserve the proposed name online | Less than one day (online procedure) | no charge (included in procedure 2) |

| 2 | A lawyer prepares and notarizes the company documents (memorandum and articles of association). | 1-2 days | Usually about B$610 = B$100 to public treasury +B$510 register of company |

| 3 | Stamp duty on the Memorandum paid to the Public Treasury | 1 day | USD 100 stamp duty is payable on the first USD 5,000 authorized capital of the company and USD 5 for every additional USD 1,000 authorized capital |

| 4 | File the company documents at the Companies Registry | 10 days | USD 300 for the Memorandum + USD 30 for the Articles of Association + USD 4 (per page) for a copy of the Memorandum and the Articles. |

| 5 | Obtain the National Insurance Number for the Company from the National Insurance Board | 1 day | no charge |

| 6 | Register the company for a business license at the Valuation/Business License Department of the Ministry of Finance. | 10 days | USD 100 (flat fee) |

| * 7 | Company Seal | 2-3 days (simultaneous with previous procedure) | USD 35 |

This is across the board but could take longer when dealing with the port if you are a foreign investors as their background checks must be done in depth.

But who quickly does an investor want to take to establish a business in The Bahamas, or even Freeport? The years it has been taking the protect out East I'm sure if passed all this time.

Now I've also check to see what, if any changes have been made in the past year to find out that there were changes made. Our government this year has made transferring property easier for reducing the stamp duty and has enhanced its insolvency process by implementing rules for the remuneration of liquidators, allowing voluntary liquidations and outlining clawback provisions for suspect transactions.

As I researched, I came across this part of a research on business by Lex Mundi member firm, McKinney, Bancroft & Hughes which states:

"9.7.1 Tax and Other Concessions: Investment in The Bahamas is and will be in an environment free from capital gains, inheritance, withholding, profit remittance, corporate royalties, sales, personal

income, dividends, payroll and interest taxes. Stamp duty is chargeable at an ad valorem rate on all property transactions and a real property tax is charged on real estate holdings, except for land holdings in Freeport, Grand Bahama. Additionally, investment incentives under the following Acts of Parliament include exemptions from the payment of customs duties on building materials, equipment and approved raw materials and real property taxes for periods of up to twenty years:

ƒ Export Manufacturing Industries Encouragement Act

ƒ The Freeport, Grand Bahama Act, 1993

ƒ Hotels Encouragement Act

ƒ Industries Encouragement Act

ƒ Spirits and Beer Manufacture Act

ƒ Tariff Act

ƒ The Bahamas Free Trade Zone Act

ƒ The Agricultural Manufactories Act

ƒ The City of Nassau Revitalization Act

ƒ The Family Islands Development Encouragement Act

ƒ The Bahamas Vacation Plan and Time-Sharing Act, 1999

Incentives may be applied for by making application to the relevant government department.

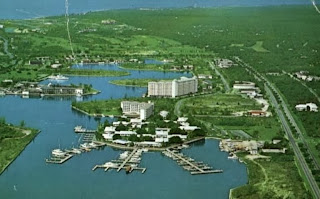

9.7.2 Freeport, Grand Bahama Island: The island of Grand Bahama, one of the islands of The Bahamas, comprises a land area of 530 square miles. Freeport is the capital city of the island of Grand Bahama and it is approximately 150 miles off the coast of Florida. Under the Hawksbill Creek, Grand Bahama (Deep Water Harbour and Industrial Area) Act of 1955 and the amendments thereto (the Hawksbill Creek Agreement) the Grand Bahama Port Authority Limited (the Port Authority), a private company, acquired from the government of The Bahamas and private owners some 149,000 acres in Freeport (the Port Area) and in order to encourage the development of this land, the government granted to the Port Authority and its licencees certain concessions which included exemption from customs duties on manufacturing supplies and other consumable stores as defined in the Hawksbill Creek Agreement, personal income taxes, corporate profit taxes, capital gains taxes or levies on capital appreciation, real property and inventory taxes. The customs duty exemption expires in 2054 and in 1993 the other exemptions were extended until August 2015. Goods for personal use or consumption are dutiable. Investors wishing to conduct business in the Port Area are required to become licencees of the Port Authority. The licencing procedure is straightforward and transparent. An annual licence fee is payable to the Port Authority by all licencees."

Interesting read.

The truth is though for a Bahamian trying to operate a business in The Port area, setting up could take about a month but all these other findings are mainly for foreign investors who are measuring the east of doing business in Grand Bahama and indeed in The Bahamas. It means the difference between a come back and a stay of stagnant waters. But we can fix it.

Comments

Post a Comment