Value Added Tax and Freeport ....

So the magic city is watching as the country attempts to implement the Value Added Tax to its books.

Good or bad, depends on the person you are talking to.

But for Freeport, as was said before, we may escape the VAT altogether.

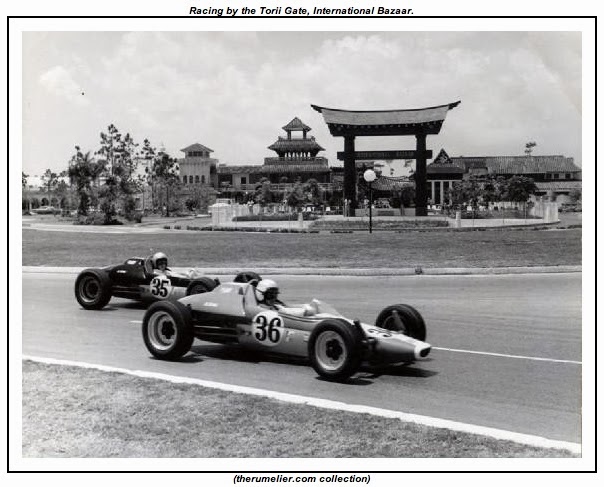

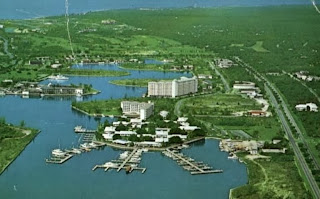

Why? The Hawksbill Creek Agreement that began this magical city.

Here is what it says to VAT: (Thanks Wayne Russell)

Good or bad, depends on the person you are talking to.

But for Freeport, as was said before, we may escape the VAT altogether.

Why? The Hawksbill Creek Agreement that began this magical city.

Here is what it says to VAT: (Thanks Wayne Russell)

14. VAT and the Hawksbill Creek Agreement (HCA)

Under Clause 2 of the HCA, the Port Authority and its licensees are exempt from customs duties and taxes on imported goods that are used for developmental or manufacturing purposes within the Port Area, or which support the administrative purposes of the Port Authority. Goods of a consumable nature are excluded from this treatment.

In the VAT draft Bill, it is stated that the VAT law would apply in the Hawksbill Creek Port Area where:

a taxable supply within the Hawksbill Creek Port Area is made by:

(i) a taxable person who is a Port licensee to a person who is not a Port licensee;

(ii) a taxable person to a person who is a Port licensee, where the supply is not of a kind or usage within the meaning of section 2of the HCA (which sets out the terms and conditions governing the duty and other tax exemptions enjoyed by the Port Authority and Port licensees);

(iii) a taxable person to another person neither of whom is a Port licensee

a taxable importation from outside The Bahamas is made into the Hawksbill Creek Port Area by a person who:

(i) is not a Port licensee;

(ii) is a Port licensee but the goods or services are not of a kind or usage within the meaning of section 2 of the HCA;

a taxable importation of goods from outside The Bahamas is made into the Hawksbill Creek Port Area for the personal use of any person;

a taxable supply of goods in the Hawksbill Creek Port Area is made by a taxable person for the personal use of any person;

a taxable person within the Port Area, whether or not a Port licensee, makes a taxable supply within The Bahamas to a recipient outside the Hawksbill Creek Port Area;

a taxable person in another part of The Bahamas makes a taxable supply to a recipient in the Hawksbill Creek Port Area who —

(i) is not a Port licensee;

(ii) is a Port licensee but the supply is not of a kind or usage within the meaning of section 2 of the HCA.

The VAT law would not apply in relation to the Hawksbill Creek Port Area where:

a taxable supply within the Hawksbill Creek Port Area is made by a taxable person who is a Port licensee to another Port licensee and the goods or services are of a kind and usage referred to in clause 2 of the HCA;

a taxable importation from outside The Bahamas is made into the Hawksbill Creek Port Area by a Port licensee and the goods or services are of a kind and usage referred to in clause 2 of the HCA.

And all this comes into affect 1st January 2015.

But no word yet on what will happen with the other concessions of the Hawkbill Creek Agreement that is due to come to a close August 2015.

Comments

Post a Comment